Contents:

Commissions do not affect the opinions or evaluations of our editorial team. Switching to a different stock broker is usually quite a straightforward process. This is a tax that you can be required to pay when you sell or dispose of an asset for a profit. Buying and selling shares through its platform is straightforward.

Some mutual funds charge a fee when the fund is bought or sold, thereby reducing how much money gets invested or the investor’s final return. Loads typically to a financial advisor to compensate them for help they offer in picking funds for offering generally financial advice. No-load funds, also called no-transaction fee funds, do not charge a trading fee. There may still be fees for things like selling the investment within a certain timeframe, however. This is a type of investment account that lets you buy and sell financial securities, like stocks, bonds and mutual funds whenever you like.

- Stock brokers let you buy and sell company shares listed on stock exchanges.

- We may, however, receive compensation from the issuers of some products mentioned in this article.

- It adopts a simple fee structure – a flat handling fee per transaction plus 0.25% on FX fees.

- EToro has built an investment platform that’s all about social collaboration and investor education.

- Consider these nine key factors to find the best broker for you.

- This leverage can increase your return on investment, but it can equally result in a huge loss.

This type of investment helps your savings stay in line with or above inflation. Overall, stock funds are a good investing option and have many benefits including being a low-risk option and offering significant appreciation potential. Customers can speak to an advisor on TD Ameritrade’s Mobile Trader app, but you can also get a quick answer from the brokers Ask Ted, service.

Pay close attention to commissions and fees, especially for the markets that are the most important to you. Also consider the technology offered by the broker and if it fits your investing style, whether you are a long-term investor or an active trader. To set up an online brokerage account, you’re going to want to start by researching the option that best suits your individual needs. There are a number of online brokerages out there, and each have their own advantages and disadvantages.

Full-service broker

Margin accounts are like a credit card, letting you buy more assets than you could with just the money you’ve deposited in your account. While investing on margin can magnify your gains, it could also magnify your losses. If you don’t have a lot of investing experience, you may want to stick with a cash account, which limits your purchases to your cash reserves, like a debit card. TD Ameritrade has raised the bar in terms of educational resources, offering content across a wide range of media. The firm has taken special care to ensure that the learning experience is immersive and interactive. The educational offerings at TD Ameritrade are second to none, ranging from in-person workshops to fully immersive curriculums, articles, videos and webcasts.

- Stock brokers with a focus on beginners may not always offer the best customer support.

- Some trading platforms for beginners also have low minimum balance requirements and offer demo versions to help get started.

- A good online broker should offer low account minimums, a robust trading platform, and solid research & analysis tools.

- For options traders, look closely at the features and tools available at a brokerage specifically for options trading.

- A spread is the difference between the price to buy the stock and the price to sell the stock.

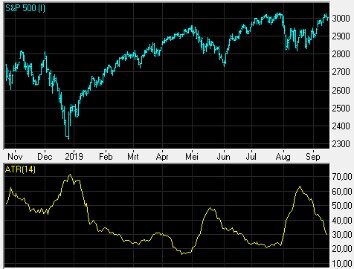

- With the industry move towards zero commissions fees, fewer brokers are charging these as of October 2019.

The flagship https://trading-market.org/ and TDA website are simpler to operate and excel at addressing the needs of most clients. To solve our own problem, we created a website that helps investors find, learn and compare the different platforms to save and invest online. Along with BUX zero, BUX’s flagship platform, you can still use BUX X to invest in CFDs and BUX Crypto if you only want to buy cryptocurrencies. Note that both of these services are expected to be combined with BUX Zero for consolidation processes as the company progresses to create a single destination for investors.

Full-service brokerage vs. discount brokerage

These resources may prove incredibly helpful if you plan on investing in stocks. Robinhood could be a good option for new investors because it’s got an easy-to-use platform that’s not too overwhelming for first-timers, although experienced investors may find it overly simplistic. Customers of SPIC-member brokerages are covered up to $500,000 for accounts at one brokerage, with a maximum of $250,000 for uninvested money. What this means is, if your brokerage is an SPIC member, you would be offered some protections if that brokerage went out of business. Another important metric to consider in seeking out the best online broker for beginners is availability of account type. But some may want a broker with a variety of account options, catering to future possible needs.

2 Reasons I’m Keeping Some of My Retirement Savings in a … – The Motley Fool

2 Reasons I’m Keeping Some of My Retirement Savings in a ….

Posted: Wed, 29 Mar 2023 14:00:29 GMT [source]

Because US stocks tend to have low-risk and good return, investors favor them as a core component to their portfolio. Overall, Acorns will suit newbies looking to passively learn about investing, but not online trading exchanges, so much. They’re not suitable for anyone with an interest in doing any extensive learning, as the firm are all about a simple approach to passive investing. Newbies won’t need to remember to fund accounts because everything is automated. If you are more interested in stocks and options, Schwab offers magnificent research and reports from third party company’s including, Morningstar and Market Edge. Beginners will also love Schwabs insights section, that includes a knowledge center, insights and ideas and investing principles for those looking to get a leg-up from the start.

Best online trading platforms

By owning shares you can sometimes be paid out dividends, which are the profits of the business being passed onto the owners . This normally happens with bigger more established companies that consistently make large profits. However if you would prefer to use an app, we’ve reviewed the best investment apps here.

TD Ameritrade is a commission-free broker that provides an all-around solid experience for beginner, intermediate, and advanced investors alike. M1 Finance also offers a paid subscription tier, M1 Plus, that provides additional offerings not just for investors, but those who bank with the service. M1 provides a generous 90-day free trial, after which the service costs $125 per year.

Each time you make a deposit, SoFi’s system will handle the distribution. Though eToro began as a cryptocurrency trading platform, the broker has recently introduced stock and exchange-traded fund trading in January of 2022. EToro’s pricing is exceptionally fast, providing you with up-to-the-minute information on what every asset currently costs. The platform’s buy-order process is also quick and intuitive, which can be a major benefit for new investors. Webull is a trading app designed to offer frequent traders an affordable method to buy and sell multiple times a day.

Migration to Schwab includes some benefits, including more no-fee mutual funds, more initial access to international exchanges, and better margin rates than at TD Ameritrade. Invest in a wide variety of products, including stocks, ETFs, mutual funds, options, bonds, forex, futures, micro futures, and futures options. You can also occasionally participate in initial public offerings . On the one hand, on the rare occasion you would need to jettison a position immediately during the trading day, you couldn’t do that with M1. And that single window is an extreme hindrance to people who want to trade stocks. From there, M1 can automatically rebalance your portfolio for you, or you can go in and manually change how small and large each Pie slice is.

What is Stock Trading Leverage? ⚖️

A robo-advisor will create a portfolio based on your risk tolerance and time horizon, and you’ll pay a low fee based on how much you have in the account. The brokerage you choose depends upon your own individual investment needs and goals. For example, if you’re looking for individual support from your online brokerage, you might want to try one of our best brokerages for customer service, such as Charles Schwab or Fidelity. Fidelity Investmentsis an all-around great choice for beginners, scoring well in every category of our review. We found that Fidelity is very competitive in the area of commissions and fees, and it provides a wealth of educational resources and dependable customer service. I didn’t mention them here since they require $1,000 minimum on their target date funds, $3,000 for most of their other funds and $10K on their Admiral series.

Trading is not gambling, although some poeple might treat it like that, but they will learn quickly that gamblers lose their money. The goal of a trader is to make predictions that will be as accurate as possible to make money, while gamblers can’t predict anything, they bet. People who trade for the thrill of it, or because they want to prove something, or can’t accept losing on the market from time to time, and don’t have a plan or consistency, are trading in a gambling style. New online trading apps have recently come under the spotlight for bringing a gambling aspect into trading.

Bestinvest: Good stockbroker for investment advice and low costs

In this section, we highlight some of the features that would make a provider stand out when comparing it with other available choices. Our focus is to provide an independent and objective assessment of each of these providers to help our readers in making an informed decision when deciding who to go with. Moreover, options and futures can also be traded with Schwab for as little as $0.65 and $1.5 per contract respectively. Futures can also be traded with TradeStation for a $1.50 fee per contract for TS Select clients and $0.85 per contract for Premium. Moreover, US treasury bonds can be traded for free, while other bonds carry a $1 commission per bond. System availability and response times may be subject to market conditions.

Firstrade takes first place in the industry for options trading. For starters, they charge no commission or contract fees on options trades. That will enable you to keep more of the profits on your trading activity.

3 Reasons I Love Holding Dividend Stocks in My Brokerage Account – The Motley Fool

3 Reasons I Love Holding Dividend Stocks in My Brokerage Account.

Posted: Tue, 28 Mar 2023 18:47:02 GMT [source]

The TD Ameritrade platform comes with advanced stock trading tools that are beginner-friendly. Overall, if you want to jump into buying and selling stocks without any fees or hassle, Robinhood could be for you. Also, we’ve put all the Robinhood’s features further on test in our comprehensive Robinhood review.

On the E-best online stock broker for beginners mobile app, you can move money using mobile check deposit in addition to other features, such as tracking the market or trading stocks and ETFs. Its other mobile app is called Power E-Trade, and allows you to enter orders, including complex options trades, on a single ticket. You’ll also get streaming news, quotes and a customizable options chain. Many online brokerages will also ask about your investing experience and goals. Once your account is set up, you can fund it directly from your bank account and begin investing in any number of investment vehicles, including stocks, bonds, ETFs and mutual funds. The best online stock brokers offer opportunities to invest in the assets you want with the lowest fees possible.