Contents:

The slope of CAL shows the additional return of a portfolio due to the additional rise in risk. Formula to calculate the slope of CAL is (Portfolio Return – Risk-Free Return)/Standard Deviation of Portfolio. Here Rf is the risk-free rate, and Rm is the expected market return of all risky assets. CML determines your average rate of success or loss in the market portfolio.

The security market line is a positively sloped line displaying the relationship between the required return from security for each given level of non-diversifiable risk. Security Market Line is the graphical representation of CAPM which shows the relationship between the required return on individual security as a function of systematic, non-diversifiable risk. On the other hand, CML describes only the market portfolios and risk-free investments. In a broader sense, the SML shows the expected market returns at a given level of market risk for marketable security. The overall level of risk is measured by the beta of the security against the market level of risk. The SML can also be used to compare securities of equal risk to see which one offers the highest expected return against that level of risk.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. SML uses the beta coefficient to calculate the risk, which, in turn, assists in determining how much security contributes to the overall risk. CML tells you at what rate is your input returning you values, that is your average rate of growth in business.

thoughts on “CML VS SML – Capital Market Line and Security Market Line| Finance”

A higher slope suggests one may get more than the expected return by adding another risky asset. Capital Market Line represents the portfolios that accurately combine both risk and return. It is a graphical representation that shows s a portfolio’s expected return based on a particular level of risk given. In simple words, CML depicts a trade-off between the risk and return for efficient portfolios.

The Capital Asset Pricing Model (CAPM) by William Sharpe. – DataDrivenInvestor

The Capital Asset Pricing Model (CAPM) by William Sharpe..

Posted: Wed, 06 Jul 2022 07:00:00 GMT [source]

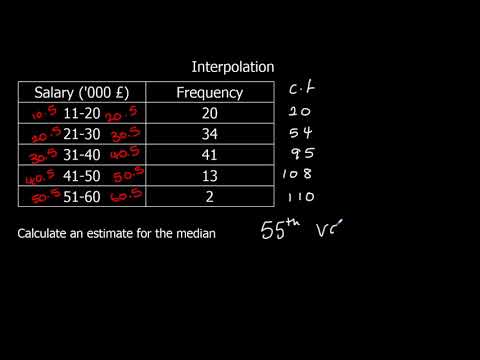

CAPM has wide applications in the investment management field where it is used to select securities for a portfolio. Explain and graphically depict how security market line is different from Capital Market Line . Identify and discuss the importance of minimum variance portfolio? Why CAPM equation might be more relevant than other equations when calculation required rate of return. Capital Market Line or CML is a tangent line representing the relationship between risk measured by standard deviation and return of the portfolio.

SML vs CML – Differences

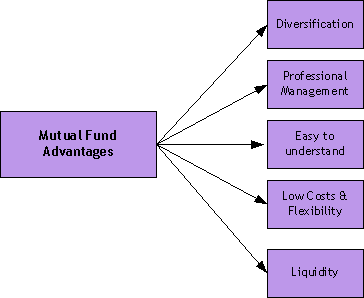

sml vs cml determines only all the security-related factors or the risk or return for individual stocks. On the other hand, CML determines market portfolio and risk-free assets, or the risk or return for efficient portfolios. On the other hand, CML is a graphical representation that tells the rate at which the securities are providing a return. In simple words, it helps to determine the degree of profit an investor makes as per their investment. Or, we can say that CML shows the rate of returns on the basis of risk-free rates and the risk level in a portfolio. Adding a risk-free asset to the portfolio of risky assets improves the risk-return tradeoff because generally, a risk-free asset has a low correlation with risky assets.

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Defines both functioning portfolio and non-functioning portfolio. We aim to be a premium yet affordable prep provider for finance certification exams. All the content on this website is authored by a CFA charter-holder.

Share this:

The security market is the representation of the CAPM model in a graphical format. The Y axis represents the level of expected return, and the X axis shows the level of risk represented by beta. Any security that falls on the SML itself is considered to be valued fairly so that the level of risk corresponds to the level of return.

- CML differs from the more popular efficient frontier in that it includes risk-free investments.

- Further, this portfolio is unique in nature such that no other combination of the securities can yield lower level of risk for the given level of expected returns.

- Security Market Line measures the risk through beta, which helps to find the security’s risk contribution to the portfolio.

- Similarly, it also shows your returns on the basis of basic merchants.

- In SML, the Y-axis represents the return of securities, while X-axis shows the beta of security.

Harry Markowitz and Merton Miller were also awarded the same. Hence, while all portfolios on the CML are efficient, the CML does not contain all efficient portfolios. Capital Market Line measures the risk through standard deviation, or through a total risk factor. The Capital Asset Pricing Model helps to calculate investment risk and what return on investment an investor should expect.

Under the standard assumptions and in the presence of a risk free investment, the capital asset pricing model can be described using two equations. Although CML tells you how quickly the input will return your value. In short, it determines how profitable you are in the market as per your investment. SML will tell you the market risk, or the chart which indicates the point where your profit may be at risk. Most importantly, SML determines adding of other assets or investments to the existing market portfolio.

It is the borderline expected returns for your investment or shares. However, some people find it more convenient to refer to the CML for measuring the risk factors. Basically, the former determines the risk or return for efficient portfolios. 5.Riskless Return • Efficient portfolios that offer the highest return for a given level of risk lie on the CML, and inefficient portfolios lie below it.

Similarly, it also shows your https://1investing.in/s on the basis of basic merchants. There are some technical details and arguments that should lay the foundation for your business. Just share your requirements and get customized solutions on time. Despite various criticisms, they stand the test due to frequent empirical testing that proves that they in fact, assist in taking investment related decisions.

CML determines the success or failure of your average market share. These make the pillars of financial management and investment management world where they hold prime importance in taking investment related decisions. SML is very important tool for analysis as it offers important information about various securities in one single graph.

Security Market line with systematic risk is measured by Beta. The risk premium on a risky security is equal to a risk free rate plus the risk premium of the risky security. Risk premium on a risky security equals to the market risk premium. This is the difference between the expected market return and the risk free rate. For a given amount of systematic risk, security market line shows the required rate of return.

SML determines the market risk you are running with your investment. As a result, it will help you in calculating your returns on the basis of the risks of investing in different portfolios. The technical details and stories that will lay the foundation for your business are important. Keep in mind the ingenious details that a rational businessman or businesswoman will pay attention to.

- As an investor moves up the CML, the overall portfolio risk and returns increase.

- However, many people feel suitable to refer to a higher level of risk so they can figure out what level of risks they should be taking.

- When entering the world of business, there are a set of terms, rules, agenda and strategy you are expected to follow if you want to have a flourishing business.

- Per the predictions done depending upon mean-variance analysis, dealers expect an attractive return compared to the risk taken.

- The CML, therefore, plays a part in assisting investors decide the proportion of their funds that should be invested in the different risky and risk free assets.

- Under Capital Asset Pricing model, risk of an individual risky security refers to the volatility of the security’s return vis – a – vis the return of the market portfolio.

It is a theoretical concept that represents all the portfolios that optimally combine the risk-free rate of return and the market portfolio of risky assets. The portfolios with the best trade-off between expected returns and variance lie on this line. The tangency point is the optimal portfolio of risky assets, known as the market portfolio.